Sen. DeMint Letter to AARP on Payroll Tax and Trust Funds

Sen. DeMint has sent a letter to AARP today regarding the organization’s position on the payroll tax holiday. Press reports from last week indicate that AARP opposes extending the payroll tax holiday because “the group simply does not want to sacrifice the Social Security Trust Fund” to do it. Officials from AARP claimed an extension would cut short a revenue stream that will be “depleted within the next 25 years….Social Security is a separate, off-budget program, with a dedicated funding source—messing with the formula shouldn’t even be a part of the budget debate.”

As a reminder, Obamacare took a dedicated funding stream for Medicare – the Medicare payroll tax – and used it to finance the new government entitlements created by Obamacare. That’s why the non-partisan CBO said that the Medicare reductions in Obamacare “will not enhance the ability of the government to pay for future Medicare benefits” – because those savings will be used to fund other unsustainable entitlements.

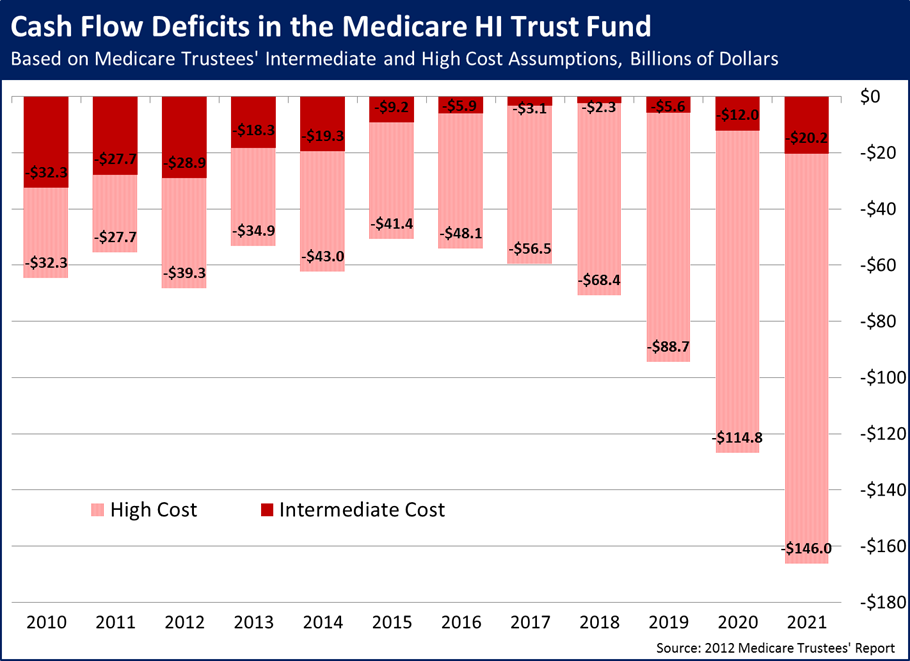

Experts agree that Medicare is in MUCH worse financial shape than Social Security – the program will become insolvent much sooner, has been running cash-flow deficits since 2008, and according to current projections, the program will NEVER come back into balance. (See, for instance, the chart below.) Yet AARP opposes the payroll tax “raid” on the Social Security payroll tax – even as it supports Obamacare’s “raid” on the Medicare payroll tax.

Mr. Barry Rand

Chief Executive Officer

AARP

601 E Street NW

Washington, DC 20049

Dear Mr. Rand:

I write regarding your October 18, 2012 letter to me and my Congressional colleagues regarding AARP’s opposition to an extension of the payroll tax holiday. Specifically, I am perplexed by AARP’s claim that diverting payroll tax revenue “would undermine confidence in Social Security and put at risk the program’s dedicated funding stream.”

AARP’s position ostensibly protecting Social Security’s “dedicated funding stream” stands in direct opposition to its endorsement of Obamacare – which diverted funding streams away from Medicare. As you know, Obamacare diverted funds from the payroll taxes used to finance Medicare for the first time ever. These funds were used not to improve Medicare’s solvency, but instead to finance Obamacare’s new entitlements. That is why the non-partisan Congressional Budget Office stated that Obamacare “will not enhance the ability of the government to pay for future Medicare benefits” – claims from AARP and the Administration notwithstanding.

As you know, budget experts agree that Medicare stands in a much more precarious financial position than Social Security. Medicare spending has consistently outgrown Social Security spending for decades, such that the Congressional Budget Office predicts spending on Medicare will exceed Social Security outlays within the next 25 years. Medicare also faces solvency concerns much more urgent than Social Security: Part A has run cash-flow deficits in the tens of billions of dollars since 2008, and according to the Administration’s own reports, these deficits will continue as far as the eye can see.

Even though Medicare stands in worse financial shape than Social Security, AARP appears focused on protecting the latter to the exclusion of the former. David Certner, your organization’s legislative policy director, claimed that AARP does not want to divert payroll tax revenues from a Social Security program that “will be depleted within the next 25 years.” Yet AARP endorsed Obamacare’s diversion of the Medicare payroll tax – despite the fact that Medicare could become insolvent as soon as 2016.

One simply cannot reconcile these two positions – opposing diversion of Social Security taxes, yet supporting diversion of Medicare taxes – as ideologically consistent. I am therefore concerned that AARP’s positions on these matters are being determined by partisan or economic considerations. As my recent report, “Profits Before Principles,” noted, AARP’s lucrative Medigap business stands to benefit financially from Obamacare’s cuts to Medicare Advantage. And recently released documents reveal AARP staff acting in an apparently non-partisan manner; for instance, one of your senior executives e-mailed the White House’s Deputy Chief of Staff in March 2010 hailing “the new AARP-WH/Hill-LeaMond/Messina relationship.”

Given your organization’s claims that your members’ interests – and not economic or partisan considerations – are at the root of your policy positions, I – and I imagine many of your members – would like to receive a greater explanation and justification of how AARP can reconcile its position opposing the diversion of Social Security payroll tax revenue, while supporting the diversion of Medicare payroll tax revenue as part of Obamacare.

I look forward to receiving AARP’s response on these issues within two weeks. If you have any questions, feel free to contact Alec Aramanda or Chris Jacobs of my staff. Thank you for your time, and I look forward to your reply.